Profit sharing vs. 401(k) plans: Comparing retirement planning options

💡 Key takeaways:

- 401(k) plans and profit sharing plans are both forms of employer-sponsored retirement benefits.

- The primary difference between profit sharing and 401(k) contributions is who is contributing to the plans.

- Profit sharing can boost employees’ retirement savings without increasing their annual taxable income.

- Businesses of any size can participate in profit sharing, even if the business isn't profitable.

If you’re an employer designing a retirement benefits program for your employees, you have many options to consider. Among those options are profit sharing and 401(k) plans — both are ways you can help your employees grow their retirement savings.

In this guide, we'll break down the benefits and key differences of each to help you identify which type of benefit is best for your team.

Key differences: Profit sharing vs 401(k)

The main difference between profit sharing and 401(k) plans is who can contribute to the plans. Only employers can contribute to profit sharing plans, while both employers and employees can contribute to 401(k) plans.

With a 401(k), all employee contributions are 100 percent vested, meaning they belong to the employee. However, with contributions in profit sharing plans, the employer can place vesting restrictions that require the employee to work at the company for a specific amount of time before being eligible to keep the total contributions.

Basics of a 401(k) plan

Businesses of any size can set up 401(k) plans for their employees. A 401(k) is a tax-advantaged, employer-sponsored retirement savings plan where employees contribute some of their salary to individual accounts. Employers can contribute to these individual accounts as well.

There are several types of provisions that you can include in a 401(k) plan:

- Traditional 401(k) employee contributions are made pre-tax and give employees a benefit today. The contributions come from an employee's paycheck before income taxes are paid. The individual pays taxes on the basis as well as all gains and earnings at the time of distribution, typically in retirement.

- Roth 401(k) employee contributions give employees a tax benefit in retirement. Employees pay tax on the contribution before it is deferred into the plan. As long as certain requirements are met, the entire amount will be tax free, including any earnings, when they are distributed from the plan.

- A Starter 401(k) plan is available to businesses with 50 or fewer employees. These plans only allow for employees to contribute (meaning employers cannot contribute directly to their employees’ retirement savings) and there are significantly lower contribution limits. Because these plans also have limited ability to exclude employees from participation, nondiscrimination testing isn’t required.

- Safe Harbor 401(k) provisions require that employer contributions are made to all eligible participants. These plans aren't subject to most annual nondiscrimination tests, and in exchange, employers must meet a few requirements every year, including notifying eligible employees in writing and applying strict limits on when participants can withdraw their contributions.

Employer contributions can be set up as mandatory or discretionary. A 401(k) plan can include several different types of contributions. Two of the most common types of contributions are matching and profit sharing contributions. Profit sharing contributions are typically given to all employees eligible to participate in the plan, and matching contributions are only given to those who chose to contribute their own money.

The IRS limits how much employers and employees can contribute to retirement accounts, including 401(k) plans. Plan contribution limits are evaluated annually and may be adjusted for factors like inflation and cost of living.

Basics of a profit sharing plan

A profit sharing plan is a plan set up by a company that only allows the employer to make contributions. The examples given below also work for profit sharing contributions made to a 401(k) plan. Since profit sharing contributions are generally done after the end of the plan year, this gives employers time to determine if and how much they want to contribute on a year to year basis. Profit sharing contributions are generally tax deductible for employers.

Employers can make contributions any year, even if the business isn’t profitable. Often, profit sharing is used as a year-end bonus for employees. These contributions can boost employees’ retirement savings without increasing their annual taxable income. (Note: employees cannot make profit sharing contributions.)

There are a wide variety of profit sharing formulas your company may use depending on your business needs and situation. The three most common are pro-rata, flat-dollar, or new comparability, also known as cross-tested.

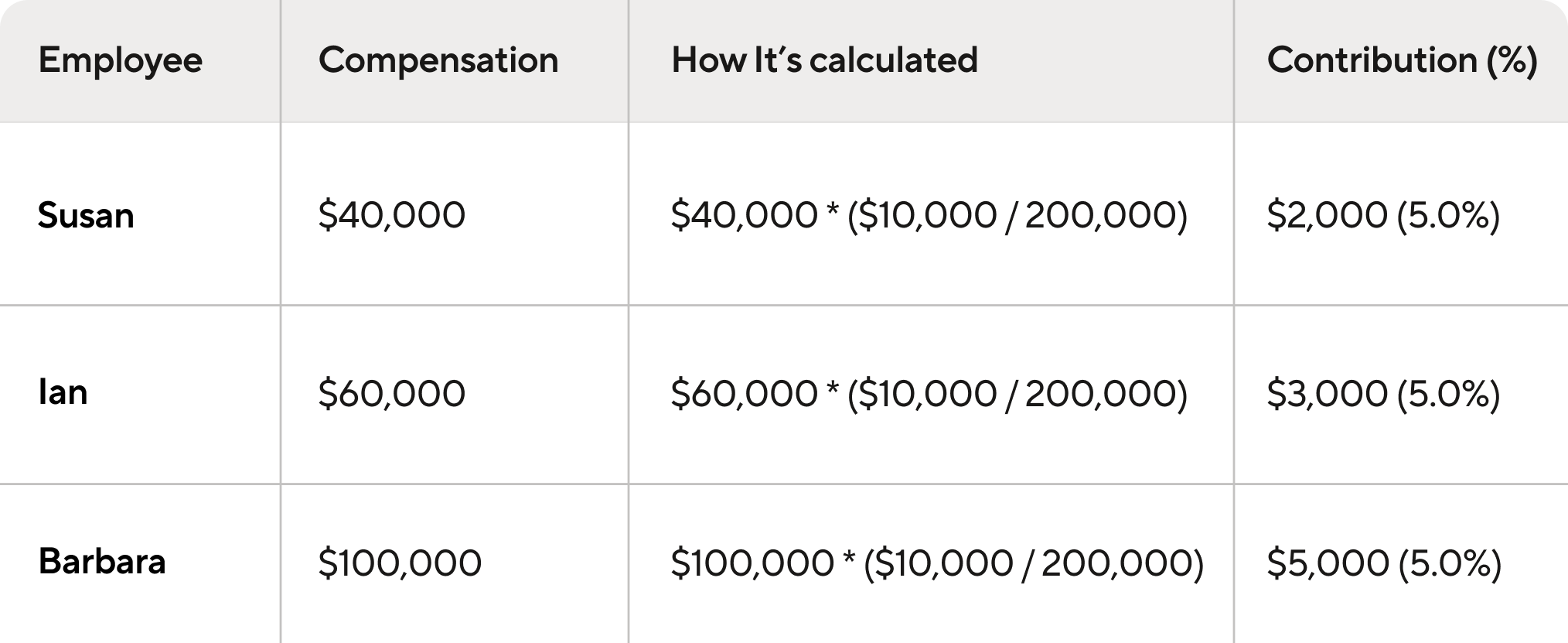

Pro-rata

With the pro-rata formula, employees receive fixed contribution amounts in equal percentages based on their relative compensation. Pro-rata is the default type of profit sharing formula for Guideline 401(k) plans.

Example:

Atmos Inc. wants to give a profit sharing contribution totaling $10,000. The amount of all eligible employee compensation is $200,000. In this case, each participant receives a contribution equal to 5% of their compensation.

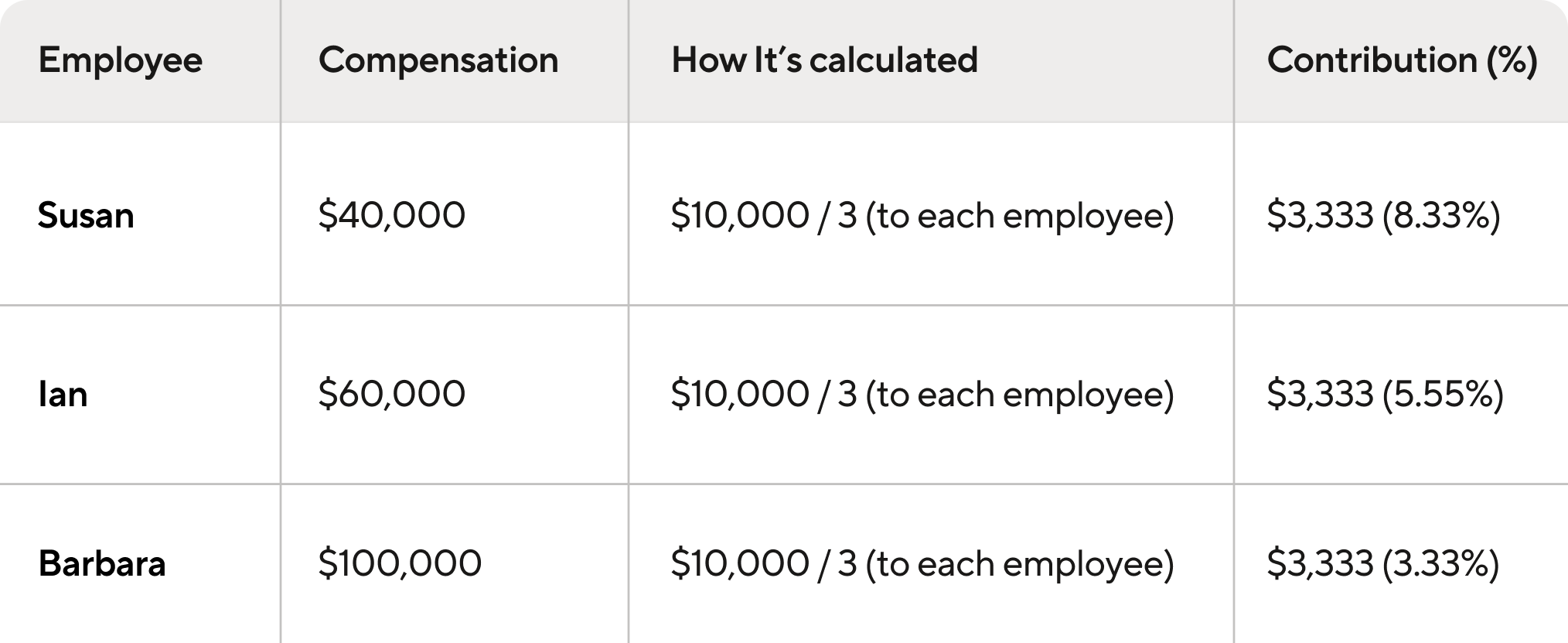

Flat dollar

Known as "same dollar amount," flat-dollar is the easiest type because each eligible employee gets the same contribution amount, regardless of how much each employee earns. The amount is determined by dividing the profit pool by the number of eligible employees.

Example:

Atmos Inc. wants to give a profit sharing contribution totaling $10,000. Three employees share it equally, receiving $3,333 each.

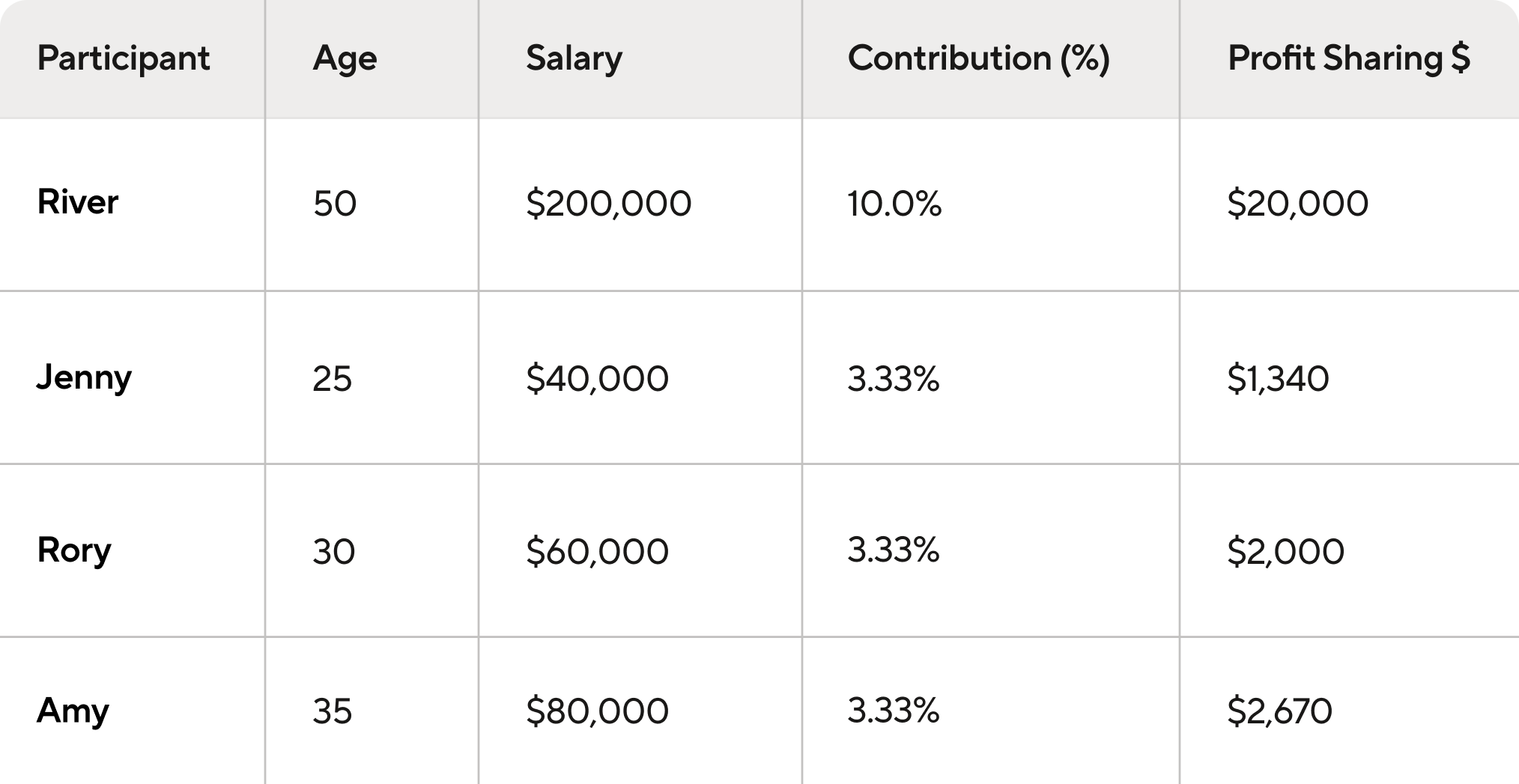

New comparability

Another formula, new comparability, offers different contributions to different groups of employees. In new comparability the testing looks at what the benefit will be worth at an assumed retirement age. Because it takes into account earnings over time, a new comparability formula often allows older, more highly compensated employees to receive a larger portion of the contribution than they could under other formulas. New comparability plans have to pass additional IRS nondiscrimination testing.

The below sample contribution shows how it works for a small business where the owner is 50 years old with a high income. Using new comparability, the owner can receive a larger contribution than younger employees with lower income.

Example:

Most employer contributions, including profit-sharing contributions, can be distributed when the employee reaches a stated event. This event is often a certain age, being a participant in the plan for five years, or becoming 100% vested.

Safe harbor contributions and employee contributions are more restricted. They generally cannot be distributed any earlier than age 59 ½ or when the employee leaves service.

Regardless of when the plan allows participants to take a distribution, if the participant is under 59 ½, there is a 10 percent penalty for early distribution unless a penalty exemption applies.

Employers can choose distribution types when they establish the plan, including lump-sum, installment, and annuity distributions. Distributions are included as ordinary income when the individual files their taxes.

- A lump-sum distribution is when the entire vested benefit is taken in a single distribution.

- With installment payments, a specified amount is paid out in regular intervals for a set period, such as $1,000 a month for 10 years, or until the account is empty.

- Annuity payments are payments stretched over the participant's lifetime but are rarely permitted in a profit sharing or 401(k) plan.

Can employers provide both a 401(k) and a profit sharing benefit?

You don't have to choose between having a 401(k) and profit sharing. If you’re designing a retirement benefits program for your company, you can provide both a 401(k) and profit sharing benefits either separately or in the same plan. While profit sharing contributions are flexible and give you the option to make contributions if you choose, 401(k) contributions allow employees to set aside some of their own money for retirement directly from their paycheck. Some years, you may not contribute to profit sharing, while other years, you may choose to contribute a lot. There's no set amount required or restrictions on business size.

Withdrawal rules and tax considerations

Both 401(k) and profit sharing contributions are opportunities for employees to save for their financial futures. But the sources have different rules about withdrawals and may have different tax consequences for both the employer and the employees. When it comes to distributions each individual plan will set when an employee can withdraw their savings. The IRS determines the earliest opportunity, but the plan may choose more restrictive options.

Withdrawal rules and considerations for 401(k)s

Individuals can withdraw their 401(k) contributions when they reach age 59 ½, terminate from service, or become disabled. The payments can be lump sum or periodic, including installment or annuity payments. If a withdrawal is taken before 59 ½, the individual may have to pay a 10% additional tax on the early distribution unless they qualify for a penalty exemption.

Because 401(k) contributions are the employee’s money, they are always 100% vested in those contributions. This means it does not matter how long they have worked for the employer sponsoring the plan — they will always receive 100% of their 401(k) contributions when they are eligible to take a distribution.

Withdrawal rules and considerations for profit sharing contributions

Individuals can withdraw their profit sharing contributions upon a stated event, which are typically related to age, length of service, or how long the money has been in the plan. Just like with 401(k) contributions, the payments can be lump sum or periodic, including installment or annuity payments. If a withdrawal is taken before 59 ½, the individual may have to pay a 10% additional tax on the early distribution unless they qualify for a penalty exemption.

Unlike 401(k) contributions, profit sharing contributions can be subject to a vesting schedule. This means that the employee may need to work a certain amount of time with the employer — no more than 6 years — or they may forfeit a certain percentage of their profit sharing contributions.

Profit sharing vs. 401(k) plans: Key considerations for employers and benefits providers

There are many factors that employers and employees should consider when looking at profit sharing and 401(k) plans.

Administrative costs and complexity

401(k) plans can require more administrative oversight than traditional profit sharing plans. As the sponsor, you are responsible for record-keeping, answering participant questions, ensuring the plan meets regulatory compliance, and providing summary plan descriptions for participants, as well as individual benefit statements for both plan types; the complexity can be greater for 401(k) plans. Because 401(k) plans involve employee contributions that will need to be collected, tracked, and applied to payroll correctly each paycycle, this plan type can be more of an administrative burden than a plan where you are only making contributions once a year.

Regulatory compliance and testing requirements

While all profit sharing and almost all 401(k) plans require nondiscrimination testing to make sure the plans are fair to all employees, there are additional tests that apply to plans with most 401(k) contributions that do not apply to plans that only allow for profit sharing contributions.

While certain profit sharing contribution formulas can result in more complex testing, most 401(k) plans have additional testing to make sure that employee and matching contributions are non-discriminatory. However, much of this complexity can be alleviated by adding a Safe Harbor provision to the 401(k) plan.

Tax implications for employers and employees

401(k) contributions are tax-deductible for employers. Traditional 401(k) contributions are taken from employee’s pay on a pre-tax basis, while Roth 401(k) contributions are taken on an after-tax basis. When an employee takes a distribution of their traditional 401(k) contributions, the entire amount will be taxed as ordinary income.

On the other hand, Roth 401(k) contributions will always be distributed tax-free, as they were taxed as the employee contributed to the plan. The earnings on Roth 401(k) contributions may come out completely tax-free if specific requirements are met, commonly called a “qualified distribution.”

Contribution limits and opportunities

Profit sharing contributions can be a great way to help employees feel empowered, rewarding them with a piece of the company's overall success.

On the other hand, 401(k) contributions empower employees with the flexibility to save for retirement in a way that best suits their personal situation and goals — whether that's pre or post-tax, or a small or significant percentage of their overall earnings. With that in mind, both contribution types are subject to some limitations.

When looking at profit sharing contributions, the total contribution cannot be higher 25% of total eligible compensation. Any amount over that 25% would not be deductible and would be subject to penalty taxes. Also, the total yearly amount an employee can contribute, which includes both what the employer puts in and what the employee defers, cannot exceed either 100% of the employee's pay or the annual additions limit, whichever is lower.

In addition to being included in the annual additions limit, each individual’s 401(k) contributions are limited to the annual deferral limit. This limit is an individual limit and will include all deferrals that an individual may make under any 401(k), 403(b), SAR-SEP, and SIMPLE-IRA in a calendar year.

Implementation and administration

Employers are responsible for setting up 401(k) and profit sharing plans. There are a lot of factors to consider when starting a plan, but you don't have to do it alone — we’re here to help you implement and manage your company’s retirement plan.

Implementing a profit sharing plan

When establishing a profit sharing plan for the first time, there are specific steps you'll need to follow, including:

- Complete and sign a plan document: This will include making decisions regarding the specific plan provision like eligibility, vesting, and distributions.

- Determine when the plan will be effective: For profit sharing plans, you can set up a new plan for a prior year up until your organization's tax filing due date.

- Arrange to work with service providers: This may include a recordkeeper, financial advisor, payroll provider, and custodian.

- Provide employees any required notification about the plan and their rights under it: The specific notices may vary based on plan provisions, such as if participants can choose their own investments.

Implementing a 401(k) plan

When establishing a 401(k) for the first time, the same formal steps that are needed for a profit sharing plan are also needed. However, since 401(k) plans include employee contributions there will be additional steps:

- Complete and sign a plan document: This will include making all of the decisions regarding the specific plan provision like eligibility, vesting, automatic enrollment, and distributions.

- Determine when the plan will be effective: To set up a 401(k) plan, the starting date must be in the future. This allows you to collect deferral elections from participants before the 401(k) becomes active. If your 401(k) plan includes profit sharing, you can establish a new plan for a past year until your organization's tax filing deadline. You can make this plan effective retroactively. In such a scenario, you'll also need to specify a future date for when deferrals will commence.

- Arrange to work with service providers: This can include a recordkeeper, financial advisor, payroll provider, and custodian. You can also work with a provider like Guideline that works directly with payroll providers for a simple, affordable solution.

- Provide employees any required notification about the plan and their rights under it: Specific notices may vary based on plan provisions, such as if the participants are going to be able to choose their own investments.

- Ensure timely employee deferrals: It's important to give all qualified employees the chance to choose a deferral, and make sure that their choices are put into action promptly.

We’ve helped more than 45,000 businesses of all sizes offer retirement benefits. Explore how 401(k) and profit-sharing plans could work for your team today.

Disclosures:

*This content is for informational purposes only and is not intended to be construed as tax advice. You should consult a tax professional to determine the best tax advantaged retirement plan for you.